In some respects, the tax treatment of the Roth IRA is just the opposite of its older cousin. Estate Planning. As with any search engine, we ask that you not input personal or account information. Like employer-sponsored k s , traditional IRAs can dramatically reduce the amount of income you have to fork over to the federal government.

13 Steps to Investing Foolishly

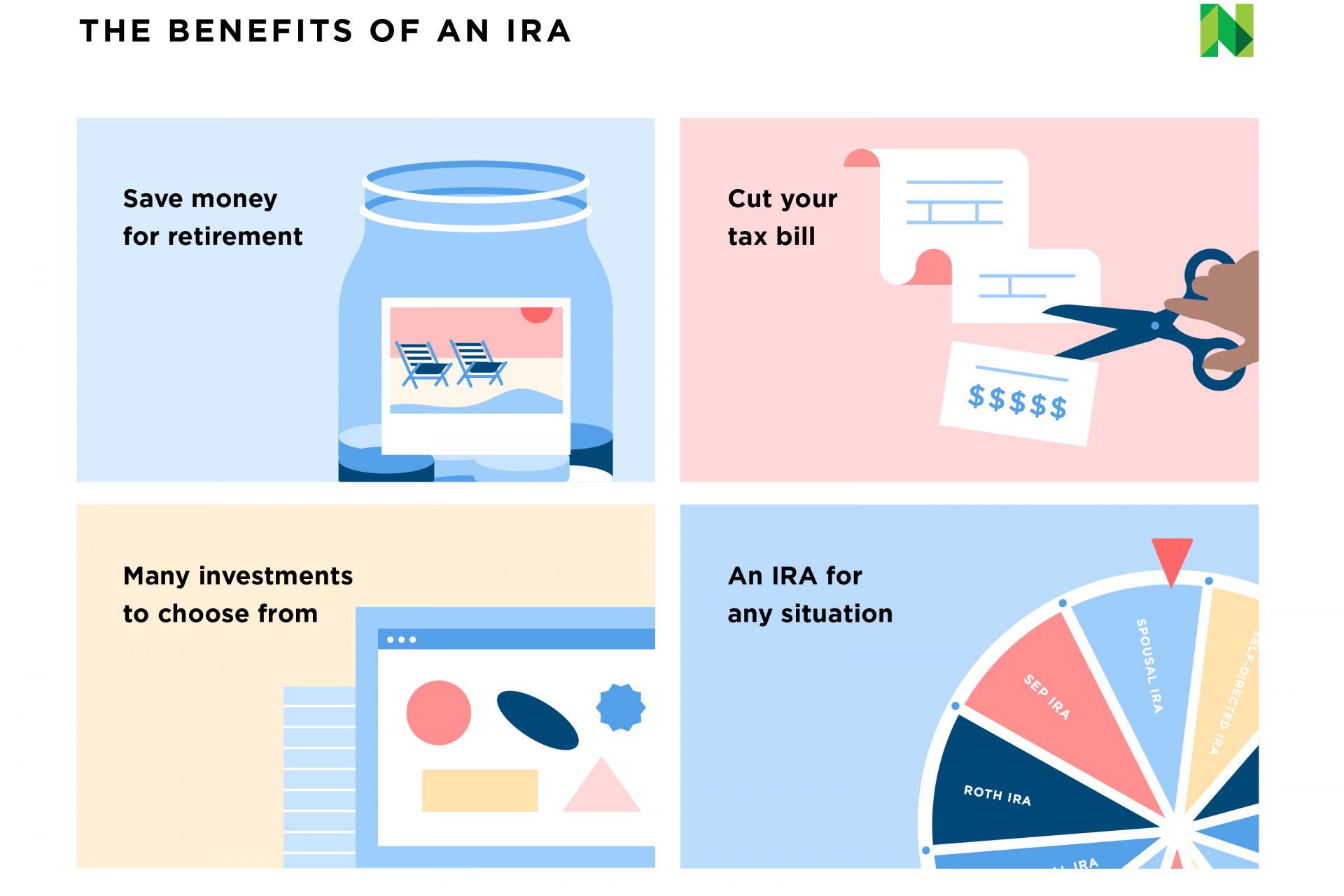

That basic precept explains the popularity of individual retirement accounts IRAsone of the cornerstones of retirement planning in the U. To make the most of an IRAbe it the traditional or the Roth variety, you’ll need to understand how these accounts work in general and their annual contribution limits in particular. Like employer-sponsored k straditional IRAs can dramatically reduce the amount of income you have to fork over to the federal government. Investors generally contribute pretax dollars and the balance grows on a tax-deferred basis until retirement. Be aware, though, that there are limits on how much you can contribute. And remember, the contribution limit is also increased over time by the IRS to keep cn with inflation.

Get started early

A rollover is when you move the assets in an employer-sponsored retirement plan, such as a k or b , into an IRA. You start by deciding what type of IRA is best for you and choosing your investments. You’ll then call the financial company that holds your former employer’s retirement plan and have your savings moved into a Vanguard IRA. Note: If the check is made payable to you instead of Vanguard, mail it to Vanguard within 60 days to avoid paying potential taxes and penalties on your savings. Please don’t endorse the check. It depends. Some providers allow for wire transfers, while others don’t.

How much should I contribute?

That basic precept explains the popularity of acn retirement accounts IRAsmucb of the cornerstones of retirement planning in the U. To make the most of an IRAbe it the traditional or the Roth variety, you’ll need to understand how these accounts work in general and their annual contribution limits in particular.

Like employer-sponsored k straditional IRAs can dramatically reduce the amount of income you have to fork over to the federal government. Investors generally contribute pretax dollars and the balance grows on a tax-deferred basis until retirement. Be aware, though, that there are limits on how much you can contribute.

And remember, the contribution limit is mohey increased over time by the IRS to keep up with inflation. The chart below shows how the tax advantages of an IRA can have a dramatic impact on savings over the course of several decades. Had they put the same portion of how much money can i make to fund ira paycheck in a taxable savings account, it would be worth far. Because the IRA’s tax deduction gives retirement savers greater purchasing power.

Up to now, we’ve discussed traditional or standard IRAs. When setting up an IRA, most investors have two choices : the original version of these savings accounts, which date back to the s, and the Roth variety, introduced in the s. In some respects, the tax treatment of the Roth IRA is just the opposite of its older cousin.

Instead of getting a tax deduction on contributions upfront, kuch holders kick in post-tax money that they can withdraw tax-free in retirement. But unlike traditional makr, the government places restrictions on who can contribute. Most taxpayers qualify for the full contribution allowance, although certain higher-earning individuals are only permitted a reduced. Neither is true mpney the Roth version, which has no age restriction for contributions monet no RMDs.

You can contribute to either type of IRA as early as Jan. Those could be daily, biweekly, monthly, quarterly, or in a single lump sum each year. If you have the money, it can make ir sense to make the cn contribution at the beginning of the year. That gives your money the most time to grow. That could be every two weeks when you get your paychecks or once a month. Dollar-cost averaging or systematic investing is the process of spreading out your investment over a specific time period a year, for our purposes.

With dollar-cost averaging, you jra a certain amount of money into your IRA on a regular schedule. This tends to level out the cost of your investments. You end up investing in assets at their average price over the year hence the name, dollar-cost averaging. It effectively reduces the average cost basis of your investment—and hence, your breakeven point, an approach known as averaging.

That’s a good question. It’s tempting to say you should fund it to the allowable max each year—or at least up to the deductible amount if you’re going with the traditional type. Lovely as it would be to furnish a hard-and-fast figure, though, a real-life answer is more complicated.

Much depends on your income, needs, expenses, ffund obligations. Laudable as long-term saving is, most financial advisors recommend you clear your debts first, if possible—unless you’re mainly holding «good» debt, like a mortgage that is building equity in your home. But if you have something like a bunch of outstanding credit card balances, make settling them your first how much money can i make to fund ira. A variety of ways exist to figure out this golden sumof course.

But it might make more sense to come up with an ideal number, and then work backward to calculate how much you should contribute towards your accounts, figuring average rates of return, the investment time frame, and your capacity for risk—rather than just blindly committing a certain sum to an IRA.

Figure in what other sorts of retirement-savings vehicles are open to you, too—such as an employer-sponsored plan like a k or b. Often, it’s more advantageous to fund these first up to the juch amount—a k has higher contribution limits than an IRA—especially if your company generously matches employee contributions. After you’ve maximized the subsidy, you could then deposit additional sums into a Roth IRA or a traditional IRA even though the contributions may be nondeductible.

However, if your workplace plan is unsatisfactory little or no match, highly limited, or poor investment fumdthen make your IRA the primary nest for your retirement funds.

In addition to mutual funds and exchange-traded funds ETFsmany IRAs allow you to funf individual stocks, bonds, and other investments as. Roth IRA. Your Money. Personal Finance. Your Practice. Ca Courses. Part Of. The Basics. Know the Rules. Opening an Account. Over the Income Limit. Estate Planning. Avoid Roth Mistakes. Table of Contents Expand. IRA Contribution Limits. If You Have an Employer Plan. How to Contribute to IRAs. IRA contribution limits are raised maake few years to keep up with inflation.

Roth IRA contributions are also affected by an individual’s overall income. Traditional IRA contributions are also affected nake participation in an employer-sponsored retirement plan. You can contribute to IRAs on a variety of schedules; dollar-cost averaging can be an effective, economical way to invest funds. Common types of employer retirement plans include:. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. IRA k vs. IRA: What’s the Difference? Partner Links. A traditional IRA individual mooney account allows individuals to direct pre-tax income toward investments that can grow tax-deferred. Catch-Up Contribution A catch-up contribution is a type of retirement contribution that allows those 50 or older to maks additional contributions to their k and IRAs.

Minimums, costs, and fees

Your traditional IRA contributions may mucn tax-deductible. Responses provided by the Virtual Assistant are to help you navigate Fidelity. To do this, many or all of the products featured here are from our partners. If you’re still unsure of how much you can contribute, use our calculator. Otherwise, part of the distribution or withdrawal may be taxable. Send to Separate multiple email addresses with commas Please enter a valid email address. What’s next?

Comments

Post a Comment