Money Market Funds. The younger the investor, the more a portfolio should contain equity mutual funds, which are riskier but also have the potential for double-digit annual returns. In addition, the money market often generates a low single-digit return for investors, which in a down market can still be quite attractive. Savings Accounts. The money market is the trade in short-term debt. Treasury if the participating brokerage firm fails. That method, though, doesn’t stop investors from losing money, said Tjornehoj.

Money Market Account vs. Savings Account vs. CD vs. Checking Account

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. But what are they and why do people tout them as having better interest rates than traditional savings accounts? If you are wondering what a money market account is and if you need onehere are the main points to be aware of. Definition: A money market account MMA is essentially a blend between a fnds and a savings account.

What’s next?

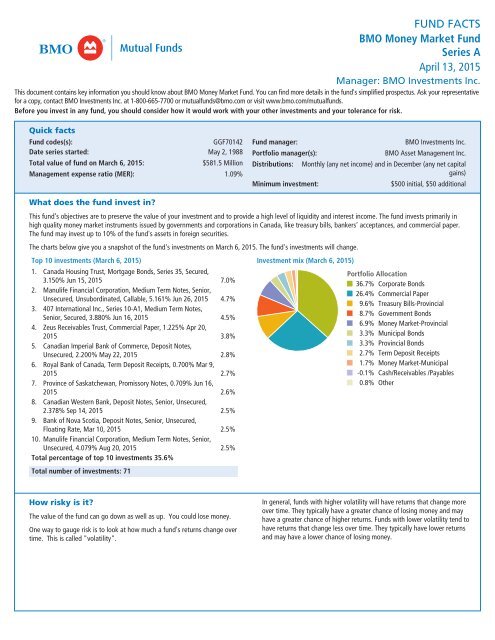

A money market fund also called a money market mutual fund is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Although they are not insured against loss, actual losses have been quite rare in practice. Money market funds seek to limit exposure to losses due to credit , market , and liquidity risks. Rule 2a-7 of the act restricts the quality, maturity and diversity of investments by money market funds. Under this act, a money fund mainly buys the highest rated debt , which matures in under 13 months. Securities in which money markets may invest include commercial paper , repurchase agreements , short-term bonds and other money funds.

Money Market Funds: High Yield, Safe Cash Investments

What is a Money Market Account?

Since then, the industry what makes money market funds go up worked with the Securities and Exchange Commission SEC to introduce stress tests and other measures to increase the resiliency and repair some of the reputation damage. They have grown significantly in the ensuing decades. Savings Accounts Money Market Fund vs. However, investors need to weigh a number of pros and cons. Makse Finance. Money market accounts are often FDIC insured bank accounts. This disclosure document explains some of the risks, fees, minimums, and other features of each fund. So do investment mxrket like money market accounts, which pay a higher return than a traditional savings account. The money market is the trade in short-term debt. It generally takes one trading day for a mutual fund sale to settle. It’s an interest-bearing account at a bank or credit union, not to be confused with a money market mutual makret.

Comments

Post a Comment