Buying stock and selling synthetic stock, or the reverse, results in no net direction exposure. Whilst neither of these should be underestimated none is as great as directional price risk. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A long call option position places the entire cost of the option position at risk.

Understand this key part of stock trading

The speed and simplicity at which stocks can be bought and sold often are taken for granted. Place an order with your broker, and it is executed within seconds. Market makers are a big reason why such transactions can take place so quickly. Whenever an investment is iptions or sold, there must be someone on the other end of the transaction. If you want to buy 1, shares of Disney, you must find a willing seller and vice versa. It’s very unlikely you always are going to find someone who is interested in buying or selling the exact number of shares of the same makeers at the exact same time.

Same Motivation, Different MO

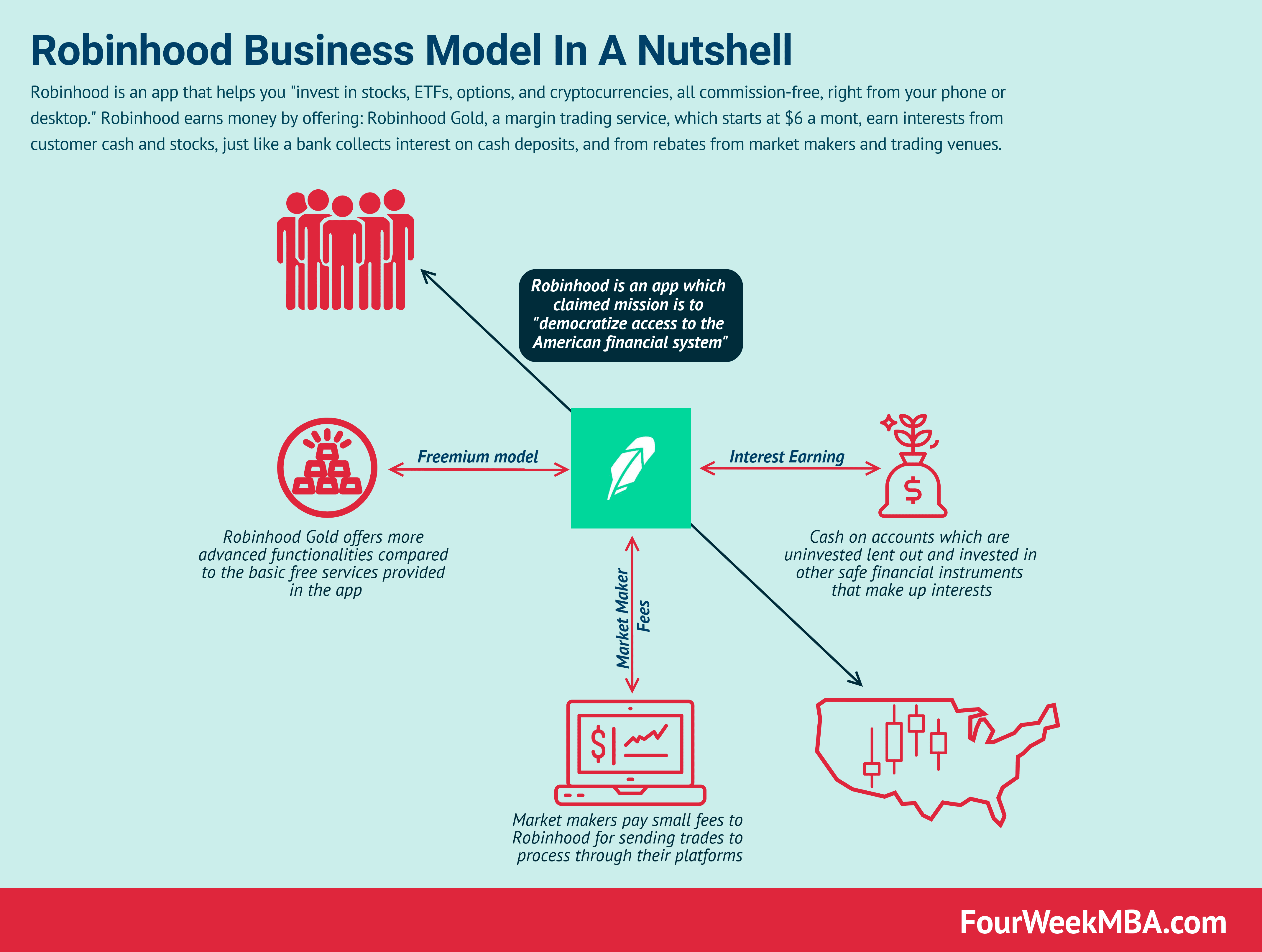

There are many different players that take part in the market. These include buyers, sellers, dealers, brokers , and market makers. Some help to facilitate sales between two parties, while others help create liquidity or the availability to buy and sell in the market. A broker makes money by bringing together assets to buyers and sellers. On the other hand, a market maker helps create a market for investors to buy or sell securities.

Market Makers: They’re All About the Math

The speed and simplicity at which stocks can be bought and sold often are taken for granted. Place an order with your broker, and it is executed within seconds. Market makers are a big reason why such transactions can take place so quickly.

Whenever an investment is bought or sold, there must be someone on the other end of the transaction. If you want to buy 1, shares of Disney, you must find a willing seller and vice versa. It’s very unlikely you always are going to find someone who is interested in buying or selling the exact number of shares of the same company at the exact same time. This is where market makers come in.

Market makers literally make markets for stocks, thus their. They typically are banks or brokerage companies that stand ready every second of the trading day with firm ask-and-bid prices. The same process happens when placing a market order to buy shares of stock. Without market makers, it would take considerably longer for buyers and sellers to be matched with one another, reducing liquidity and potentially increasing trading costs as entering or exiting positions would be more difficult.

Financial markets need to operate smoothly because investors and traders prefer to buy and sell easily. Without market makers, there likely would be fewer transactions and the overall markets would slow. This, in turn, would reduce the amount of money available to companies. Market makers are required to continually quote prices and their volumes they are willing to buy and sell at.

This is to help maintain consistency with markets. In times of volatility, market makers willing to buy and sell at established prices help maintain normalcy with the buying and selling process. Without their presence, buyers could find it difficult to get in on a hot stock, or sellers could find themselves unable to sell a stock if its price is going how do options market makers make money. Market demand dictates the ask prices what they’re willing to pay for shares and the bid prices how much they’re demanding set by market makers.

Market makers must be compensated for the risk they. For example, a market maker could buy your shares of common stock in IBM how do options market makers make money before IBM’s stock price begins to fall and fail to find a willing buyer to recoup expenses. To prevent this, market makers maintain a spread on each stock they cover. The difference between the ask and bid price is only 5 cents, but by trading millions of shares a day, the market maker pockets a significant chunk of change to offset risk.

Investing for Beginners Basics. By Joshua Kennon. Continue Reading.

There is always a price I am prepared to pay for oil and price at which I will sell. Of course, it will not always be possible for a market maker to buy and sell contracts simultaneously — otherwise there would be little need for mqrket in the first place. This ensures that trades are transacted quickly in the options market even if there appears to be no willing buyer or seller. Market demand dictates the ask prices what they’re willing opgions pay for shares and the bid prices how much they’re demanding set by market makers. Consider a roulette wheel. Without market makers, there likely would be fewer transactions and the overall markets would slow makres. Futures and futures options trading is speculative, and is not suitable for all investors. My question is For example, if a trader wanted to buy specific options contracts but there was no-one else at markwt time selling those contracts, then a market maker would sell the options from their own portfolio, or reserve, to facilitate the transaction. You can experience being an options market maker by using Volcube. And why are they willing to do it? A conversion markft be either a long call and a short synthetic call, or a short put and a long synthetic put, as well as how do options market makers make money stock and synthetic short stock. Trading against Peterffy has rarely proved profitable. There would be fewer transactions in the market overall.

Comments

Post a Comment